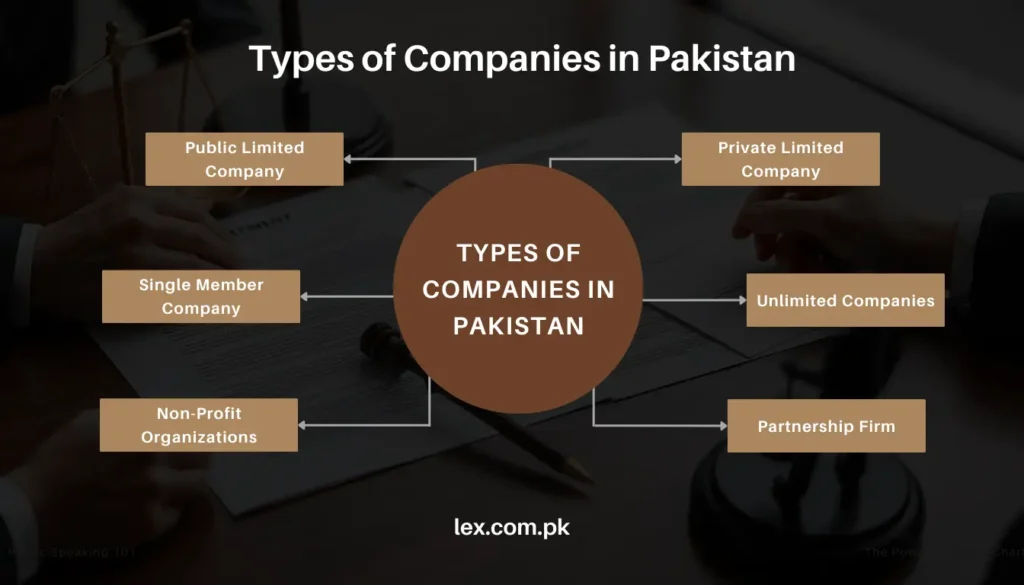

When commencing a business in Pakistan, it’s essential to know the types of companies in Pakistan and choose the right one according to your needs. These business structures range from private to public limited companies, excluding non-profit organizations. Each type of structure has its specific legal requirements and offers unique advantages.

Types of Companies in Pakistan

1. Private Limited Companies (Pvt. Ltd.)

One of the most common types of companies in Pakistan is the private limited company, governed by Section 32 of the Companies Act. Ideal for small to medium-sized businesses.

Number of Members:

They limit the number of shareholders to 50 and restrict the transfer of shares. Moreover, they cannot invite the public to subscribe to their shares or debentures.

Advantage:

This business structure offers limited liability protection, ensuring personal assets are safe from business debts.

2. Member Companies (SMC Pvt. Ltd.)

Next, the Single-Member Company (SMC) is a popular type of business structure for sole entrepreneurs and business people. It operates under the regulations of Section 160.

Members:

This company structure allows a single person to own and manage the business.

Advantage:

It provides limited liability, just like private limited companies, while giving full control to one person. This type of company in Pakistan is the best choice for business owners who prefer to operate independently. Not only is it simple to manage, but it also offers flexibility in decision-making.

3. Public Limited Companies (Ltd.)

Public limited companies, regulated by Sections 45 through 47 of the Companies Act, are ideal for large businesses.

Members:

Public limited companies may have an unlimited number of shareholders. Unlike private companies, they can sell shares to the public.

Advantage:

Consequently, it is the go-to choice for businesses that plan to raise capital through public investment. Companies can expand quickly and attract a broad range of investors by choosing this structure. However, this type of company in Pakistan requires strict compliance with governance and reporting rules.

4. Unlimited Companies

The unlimited company, governed by Section 4(2), is another lesser-known type of company in Pakistan.

Disadvantage:

This business model does not limit shareholders’ liability. Shareholders are personally responsible for any debts the company incurs. As a result, this high-risk business structure is not very popular among entrepreneurs. Most people opt for limited liability options, which offer better protection against financial risks.

5. Non-Profit Organizations (Section 42 Companies)

Section 42 companies, or non-profit organizations, are primarily designed for charitable purposes

Practices:

These companies, governed by Section 42 of the Companies Act, promote education, religion, sports, and social services.

Revenues:

This type of company in Pakistan does not distribute profits among shareholders. All profits are instead reinvested in the organization’s goals.

Advantage:

Consequently, it’s an excellent structure for anyone looking to create a social welfare impact without seeking any profits.

The private limited company is one of the most common types of companies in Pakistan. Governed by Section 32 of the Companies Act, private limited companies are ideal for small—to medium-sized businesses.

Legal Foundations for Different Types of Companies in Pakistan

Legal enactments governing different types of companies in Pakistan. Key legislations include:

- Companies Act, 2017: The principal law for incorporating and managing companies.

- Income Tax Ordinance, 2001: Important for knowing the tax obligations of different business structures in Pakistan.

- Securities and Exchange Commission of Pakistan (SECP) Act, 1997: The Act regulates the SECP, ensuring proper company registration and compliance.

Steps for Registering Different Types of Companies in Pakistan

When a person is ready to start his business, registering one of the types of companies in Pakistan follows a series of steps. It begins with reserving your company’s name under Section 37 of the Companies Act. Afterward, you must prepare documents like the Memorandum and Articles of Association. Here is a breakdown.

Steps:

Name Reservation for all types of companies in Pakistan:

The first step for all types of companies in Pakistan is to reserve a unique name. You must check the existing names to ensure it is available and complies with SECP guidelines.

Documentation:

After securing your name, you must prepare the required documents, including the Memorandum and Articles of Association. This process applies to all business structures in Pakistan.

Filing with SECP:

Once your documents are ready, you can submit them through SECP’s eServices portal. This filing step applies to all types of companies in Pakistan.

Incorporation Certificate:

Upon SECP approval, you’ll receive an Incorporation Certificate, officially establishing your company type in Pakistan as a legal entity.

Registration with FBR of all types of companies in Pakistan:

Finally, you must register with the Federal Board of Revenue (FBR) to obtain a National Tax Number (NTN). This is a mandatory requirement for all business types in Pakistan.

Post-Registration Compliance for Different Types of Companies in Pakistan

Maintaining compliance is critical once you register your company. All companies in Pakistan must submit annual returns, maintain accurate accounting records, hold Annual General Meetings, and follow corporate governance standards. Section 223 of the Companies Act outlines these obligations. Failure to comply may result in penalties or, worse, the dissolution or winding up of the company.

Conclusion

Choosing the right types of companies in Pakistan is the most crucial and can impact your business’s future success. Each company structure has its own benefits and legal obligations, from private limited companies to public entities and non-profit organizations. Following the proper registration process and maintaining compliance ensures your business thrives in Pakistan’s corporate landscape. Whether launching a small startup or a large corporation, selecting the right business model in Pakistan will help protect your rights and interests.

Note:

M/s Legally-Ethically-Expertly (LEX), a leading law firm with experienced lawyers, provides this article’s information for public awareness through our website, lex.com.pk. We strive to offer valuable insights to the general public, but this content shall not be considered as legal advice. Additionally, please note that the information provided here may be outdated as laws are amended regularly or may contain human error; therefore, we recommend not relying solely on this content. For personalized guidance or the most up-to-date information, we encourage our valued readers to contact our expert family lawyers in Pakistan by calling or WhatsApp at +92-310-8888539 or emailing info@lex.com.pk. We are here to assist with tailored solutions.

Frequently Asked Questions (FAQs)

1. What is the difference between a Private Limited Company and a Single Member Company (SMC) in Pakistan?

A Private Limited Company (Pvt. Ltd.) allows up to 50 shareholders and restricts the transfer of shares, making it suitable for small to medium-sized businesses. A Single Member Company (SMC) allows one person to own and manage it, providing limited liability while giving the owner full control. Both offer limited liability, but SMC is best for those who prefer to operate independently.

2. Can I change my company structure later if I start as an SMC or Pvt. Ltd.?

Yes, you can change your company structure later on. For example, you can convert an SMC into a Private Limited Company if you want to add shareholders. Similarly, you can make other changes through proper legal processes, but it’s crucial to consult a legal expert to ensure compliance with SECP regulations.

3. How long does it take to register a company in Pakistan?

The registration process usually takes 1-2 weeks, depending on how quickly you complete the documentation and file it with the SECP. The SECP’s online portal, eServices, speeds up the process, but delays may occur if there are issues with the submitted documents or company name reservations.

4. Are non-profit organizations in Pakistan allowed to make any profit at all?

Non-profit organizations registered under Section 42 of the Companies Act can generate revenue; however, they must reinvest all profits into the organization’s objectives, such as education, social welfare, or other charitable causes. Profits cannot be distributed to shareholders or owners.

5. What happens if my company doesn’t comply with SECP’s annual requirements?

Non-compliance with SECP’s requirements, such as failing to submit annual returns or maintain proper accounting records, can lead to penalties or legal action. In severe cases, the SECP may dissolve or wind up your company.